62015 Date Of Publication. COMPUTATION OF CAPITAL ALLOWANCES Public Ruling No.

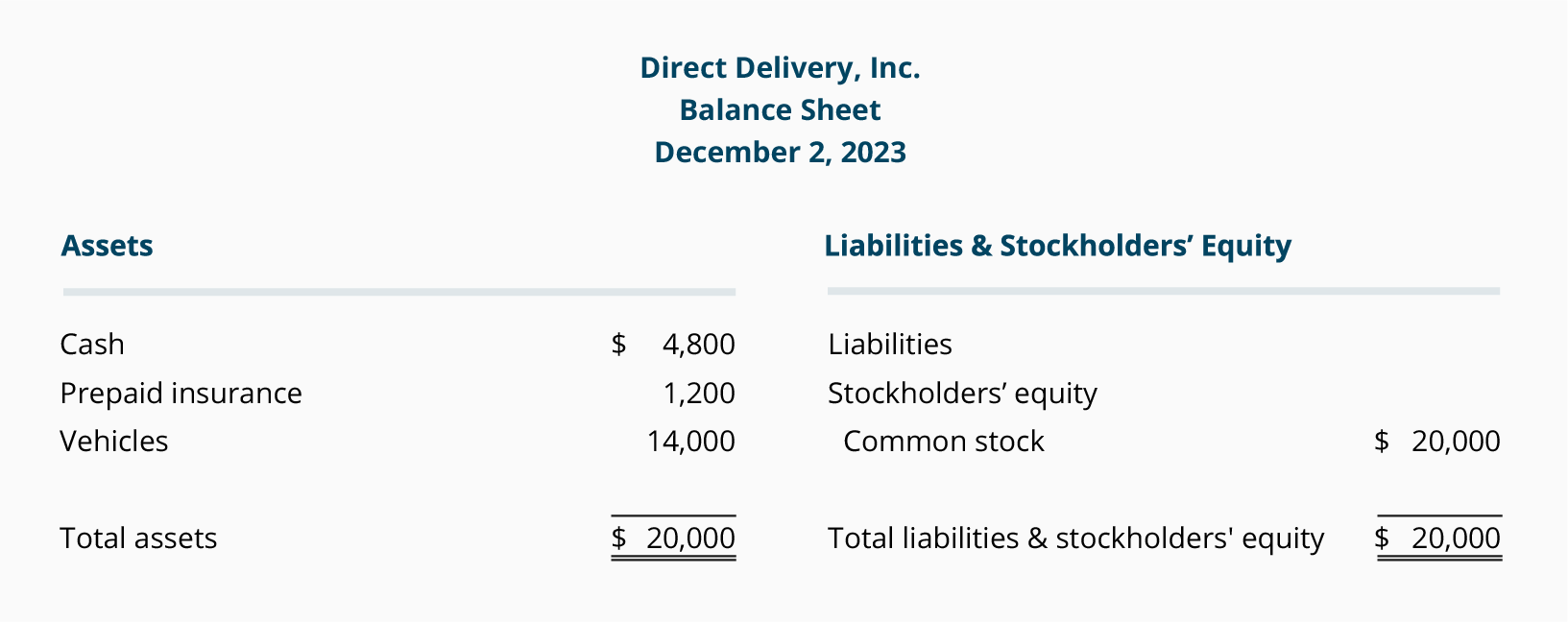

Accounting Basics Purchase Of Assets Accountingcoach

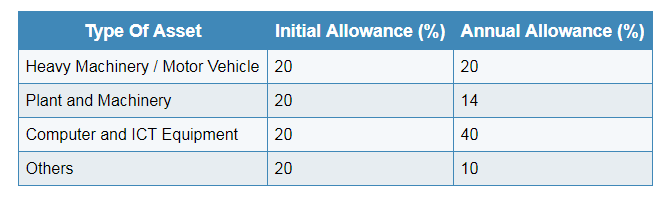

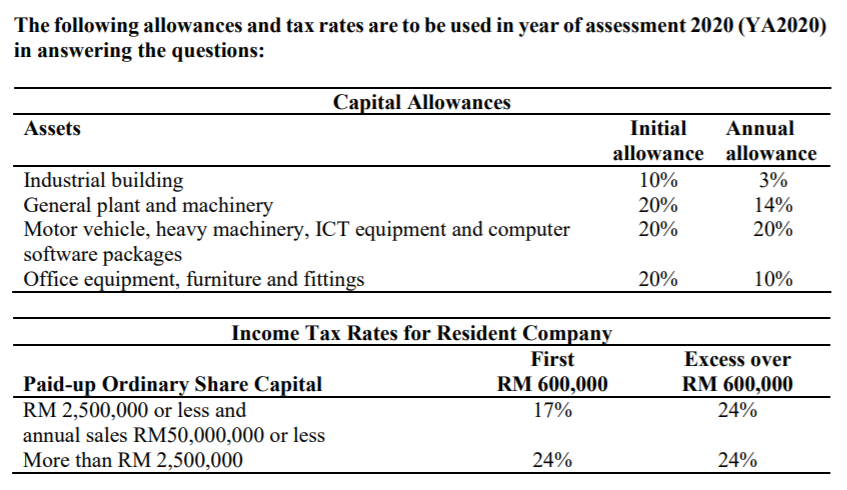

Asset Initial Allowance Annual Allowance.

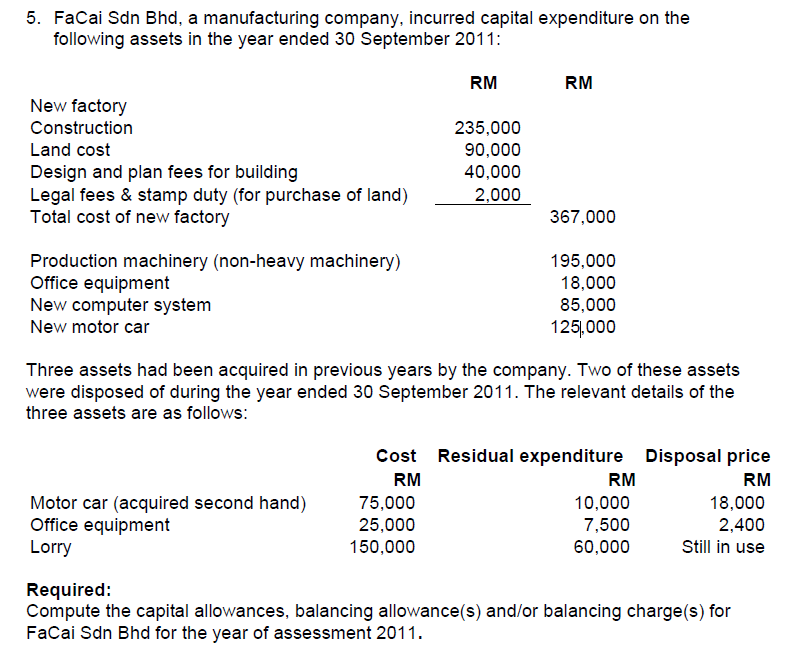

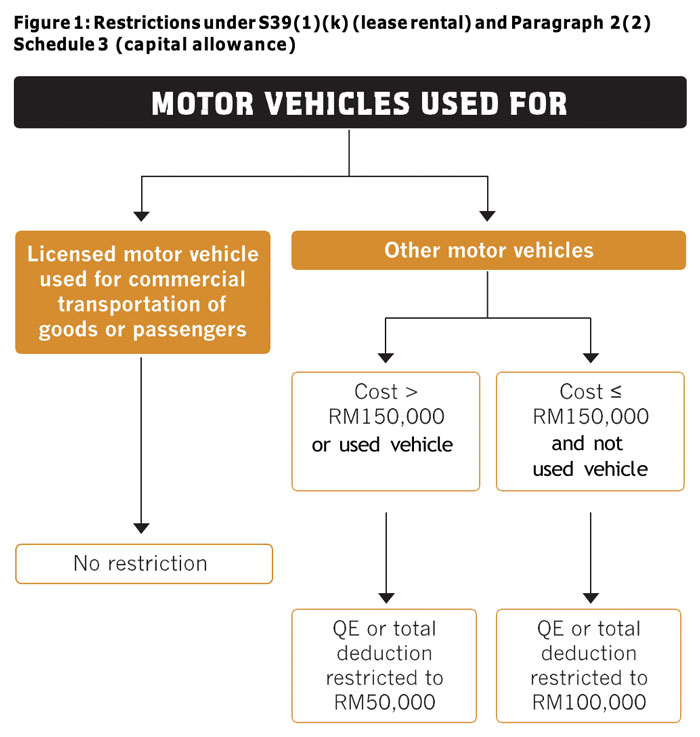

. Cardata makes sure youre compliant. Motor vehicle for Capital Allowance is classified into 2 categories. Motor vehicle will be classified into 2 categories-Commercial car such as van lorry and bus.

This would result in a 50 reduction to the capital allowance claimed. The purpose of capital allowance is to give a relief for wear and tear of fixed assets for business. How are Capital Allowances Calculated.

Passenger private vehicle. Capital allowances cannot be claimed on the costs of private cars eg. Capital allowances are generally calculated on the net cost of the business asset or premises.

Dont let the IRS cause you any stress. It is granted to a person who owns depreciable assets and use those assets in. Commercial vehicle van lorry and bus What is eligible for capital allowance.

Capital allowance is only applicable to business activity and not for individual. Ad Empower your drivers to choose their own car Give them a fair non-taxable allowance. You may pay your fine using Cash Check Money Order or Credit Card Visa Master or Discover Card.

Dont let the IRS cause you any stress. Rates and Fees Refunds TCC TRN FATCA GCT on Government Purchases Direct Banking Direct Funds Transfer. S-plated cars and business cars eg.

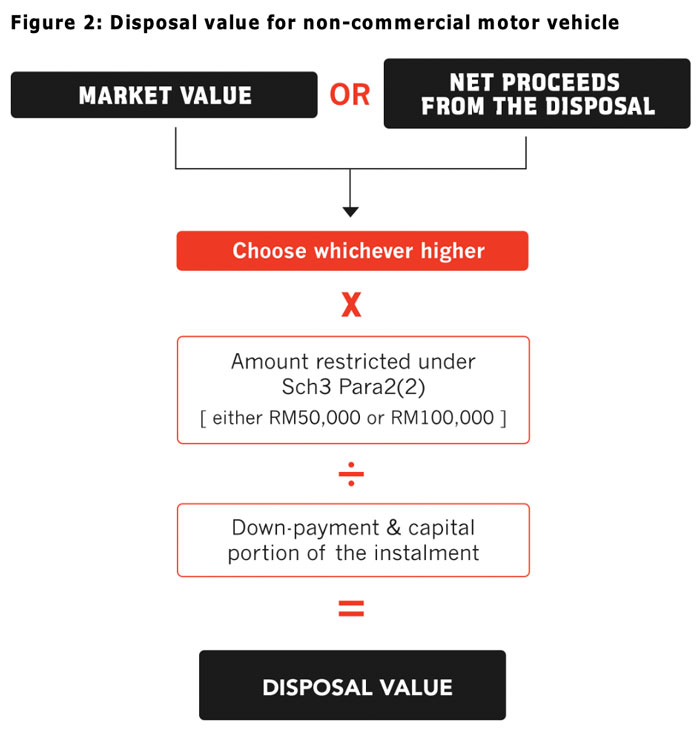

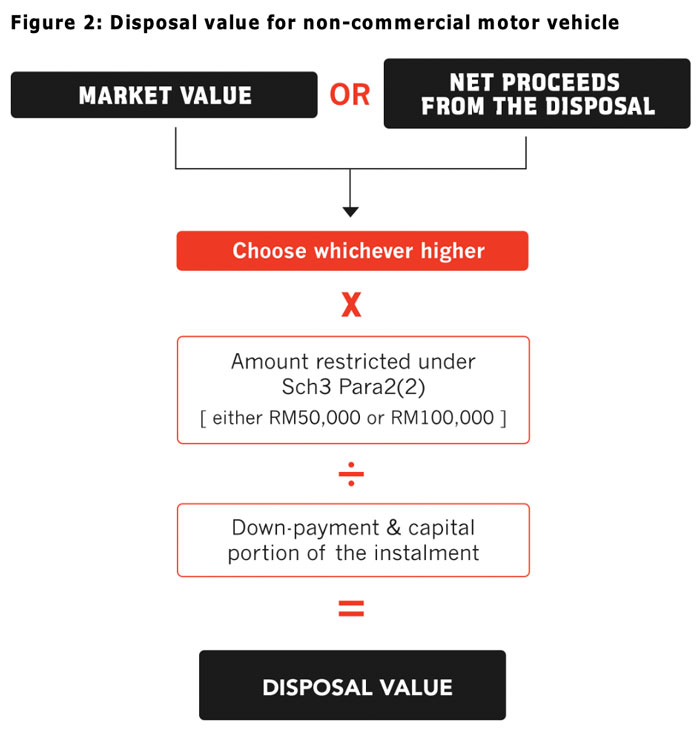

This example illustrates how to compute CA for non-commercial motor vehicle when Hire Purchase option is being used. You purchase a motor vehicle for 10000 with CO2. 27 August 2015 _____ Page 4 of 22 52 Vehicle a QE for a vehicle licensed for commercial.

It further illustrates how to determine. A taxpayer can claim both IA and. No initial allowance is granted.

Cardata makes sure youre compliant. Calculate the annual allowance AA. There are different rates available depending on the type of asset.

Capital Allowance Claim for Motor Vehicles. Annual allowance rate Cost of the asset minus initial allowance. This is a standardised deductible allowance in place of Financial Accounting depreciation.

Office hours are Monday through. Q-plated and RU-plated cars. Ad Empower your drivers to choose their own car Give them a fair non-taxable allowance.

The annual allowances for private motor vehicles is to be computed on the deemed cost of 3200. Vehicles need to be inspected once every two years in New Jersey with the exception of new vehicles. Qualifying expenditure QE QE includes.

New vehicles need a five-year inspection. Motor Vehicle Drivers Lic. 455 Hoes Lane Piscataway NJ 08854 Phone.

- cost of assets used in a business such as plant and machinery office equipment furniture and fittings motor. The rate for Initial Allowance and Annual Allowance is 20 respectively. An accelerated allowance of 100 is given by reference to.

Initial allowance is a one-off relief. There is an enhanced scheme of Capital Allowances for expenditure incurred on a car which is electric or runs on alternative fuels. Time of Appointment for October 07 2022.

1975 Leyland Australia Jaguar Xj6 Xj V12 Aussie Original Magazine Advertisement Jaguar Car Jaguar Xj12 Jaguar

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Irs Announces Luxury Auto Depreciation Caps And Lease Inclusion Amounts Doeren Mayhew Cpas

Dodge Repair Financing 2 Important Facts That You Should Know About Dodge Repair Financing In 2021 Finance Repair Important Facts

Fixed Asset Trade In Double Entry Bookkeeping

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Solved Annual Allowance 20 14 40 10 Type Of Asset Chegg Com

Solved Annual Allowance 20 14 40 10 Type Of Asset Chegg Com

Vehicle Programs The Guide To Vehicle Reimbursement Programs

Why Is A Car Allowance Taxable What Sets This Vehicle Program Apart

Home Department Directs Creation Of 500 Traffic Police Posts Across Odisha Police Post Traffic Police Traffic

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

2022 Everything Your Business Needs To Know About Favr

The Following Allowances And Tax Rates Are To Be Used Chegg Com

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Preparing The Capital Allowance Computation Acca Taxation Tx Uk Youtube

Compare Car Iisurance Compare Auto Lease Vs Purchase Car Lease Compare Cars Lease